E-invoicing allows tax authorities to automate the filing of returns. Instead of manually auditing companies or conducting surveys, they can collect data directly from a business’s transactions, at the transaction level. This makes it possible to process more taxes in a quicker and more efficient manner.

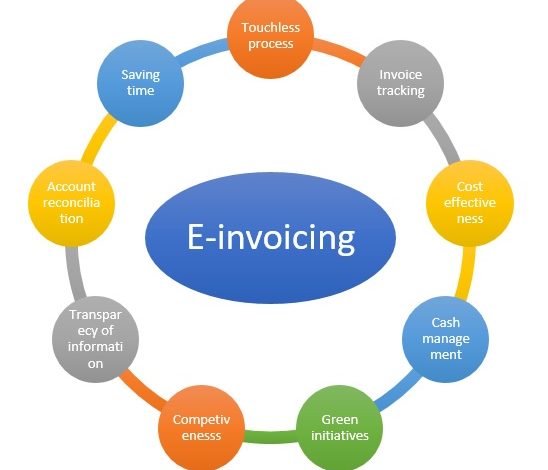

There are many advantages to E-invoicing under GST, including the reduction of data entry errors, increased transparency, and faster payment processing. Currently, businesses use different software platforms to generate invoices. The details of invoices are manually enter into a GSTR-1 form. This is follow by a GSTR-2A form, which is in a ‘view-only’ format. Transporters must also generate an e-way bill. In addition, consignors can import invoices in a JSON or Excel format.

Once a business reaches a certain turnover threshold, it can opt for the e-invoicing system. Currently, only businesses with a minimum turnover of Rs five crore can opt for the system. For businesses with higher turnover, e-invoicing will be mandatory.

Under the GST regime, businesses with a turnover of more than Rs ten crore will be required to use e-invoicing. Additionally, e-invoicing is required for additional vendors starting April 1, 2022. If a business fails to comply, the recipient will not be eligible for input tax credits. Moreover, invalid invoices can lead to penalties.

The system is designed to make GST compliance easier and less complicated. It also makes the creation of invoices more efficient, so the tax office can focus on reducing paperwork. Businesses that generate over 20 crores of revenue every year will need to use the e-invoicing system to streamline their accounting processes.

Benefits E-invoicing under GST

E-invoicing under GST is a great way to increase business efficiency and reduce tax leakage. Previously, invoices had to be print or mail, but this is no longer necessary. All businesses must register their invoices online with the GST system and include a unique invoice identification number. Once invoices are register, a portal will generate a QR code with all of the relevant details, including the digital signature.

This means that you can now send your invoices directly to customers by email or through an app on their devices. The QR code also allows you to track sales and payments much more easily than before when you received paper documents in the mail each month from your accountant.

Read more useful related content: 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗿𝗲𝗲 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝗶𝗻𝗴 𝗦𝗼𝗳𝘁𝘄𝗮𝗿𝗲

Invoices generated by e-invoicing software will be consistent and accurate. This eliminates the need for manual data entry and makes invoices easier to communicate. The system will also reduce data entry errors by using pre-populated fields. Additionally, the e-invoices will be compatible with other software programs, making it easy to integrate and share data between software.

The GST portal will also provide you with an online filing system so that you can quickly and easily upload your documents like draft sales contracts and purchase orders.

E-Invoicing is a great way to increase business efficiency and reduce tax leakage. Previously, invoices had to be print or mail, but this is no longer necessary. All businesses must register their invoices online with the GST system and include a unique invoice identification number. Once invoices are register, a portal will generate a QR code with all of the relevant details, including the digital signature.

Read more content: Click Here